By Ray Cardello for November 23, 2024, Season 30 / Post 5

The saying goes, “As goes California, so goes the nation.” If this is true, we better have a gut check soon, as California is in a downward spiral. The state has been mismanaged and is on the wrong moral compass heading. It is a geographically diverse state with incredible beauty and resources. Yet, it is in one of its most significant population declines due to out-of-control restrictions and cost of living. Ironically, the man in charge of this failing state, Governor Gavin Newsom, is one of the rising stars of the Democrat Party. The last thing our country needs is to have the disastrous policies of the Golden State become those of America.

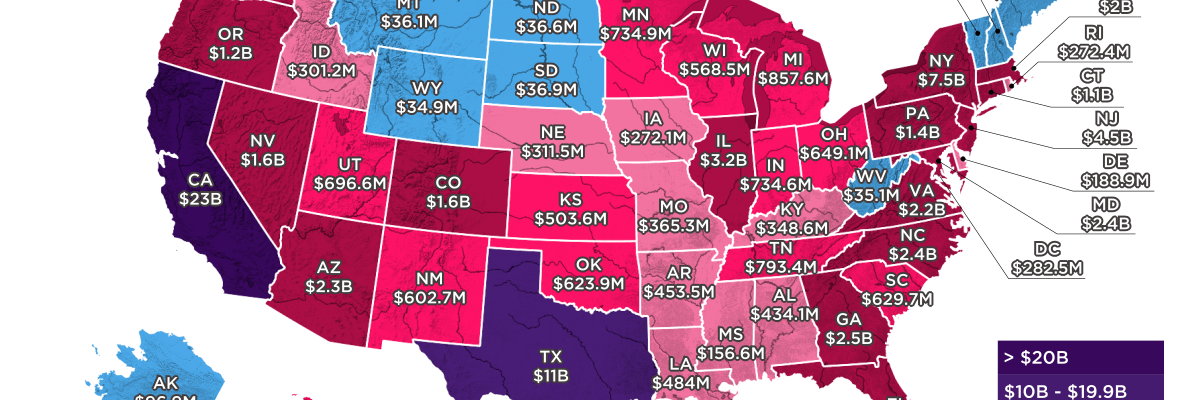

The driving influence creating a high-cost burden on California residents and taxpayers is the out-of-control influx of illegal migrants attracted to the many sanctuary cities in the state and the many jobs available in agriculture and service industries. The percentage of illegals to citizens is 27%, which is unsustainable. That means one in four residents in California is a drain on social and welfare services, healthcare, and housing. This also strains the education system tremendously and negatively impacts the overall outcome for all children. Is it any wonder that people have been leaving the state in droves, heading to states like Texas, Florida, and Tennessee, where living conditions are superior and costs more reasonable? Unfortunately, this departure puts an even greater burden on those who cannot leave.

Some of the exorbitant taxes are 14.4% state income tax and 13.3% on capital gains. There are efforts to raise the 14.4 to 16.8%. Apparently, there is no ceiling in California. Combine the federal capital gains of 23.8% to the 13.3%, and you have the highest rate anywhere in the world at 37.1%. That is not a world record to be proud of.

Californians will need an extra $1,000 yearly to cover the new gas costs and taxes. Two weeks ago, the California Air Resources Board passed a new unique blend mandate for California’s Low Carbon Fuel Standard.

The board has already said the mandatory new special blend will increase the retail price of gasoline by 47 cents per gallon, and the new gas tax adds another $.65 a gallon. If the taxes are a punch to the jaw, the latest regulations and restrictions are a blow to the gut.

California has a two-tier sales tax with a combined average Sales Tax (With Local): 8.685%. California has state sales tax of 6%, and allows local governments to collect a local option sales tax of up to 3.5%. The Sales Tax disproportionately impacts the lower income brackets and certainly the illegal population.

EV and appliance mandates are confounding as they will add to the out-of-control demand for electricity. The electrical grid is inadequate today and requires scheduled brown and blackouts in some areas. The 27% of the population working low-income jobs will not be paying for the needed infrastructure upgrades.

With the Democrat Party deeply entrenched in California, you will not see any of these situations improving. Top it off with rising crime rates, the influx of Venezuelan gangs, and liberal DAs, and the rest of the country hopes that Newsom never gains an office outside of California and that this madness stays right where it belongs: in the hills of Beverly, or the cable cars of Frisco.

Categories: Uncategorized